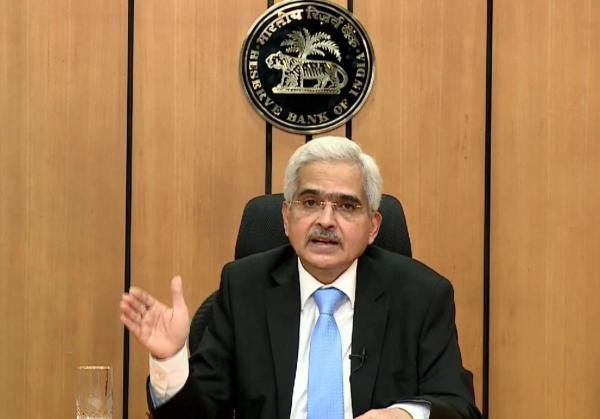

At 10:00 a.m. on Friday, RBI Governor Shaktikanta Das will make the announcement regarding the Monetary Policy Committee (MPC) decisions of the Reserve Bank of India (RBI). It appears that this evaluation, which is ongoing as of Wednesday, will not allow the interest rates to be changed. Shaktikanta Das, the RBI’s monetary policy announcement today. Interest rates remained the same? Desk on the Internet: At 10:00 a.m. on Friday, RBI Governor Shaktikanta Das will make the announcement regarding the Monetary Policy Committee (MPC) decisions of the Reserve Bank of India (RBI). It appears that this evaluation, which is ongoing as of Wednesday, will not allow the interest rates to be changed. The repo rate was left at 6.5 percent by the RBI in February 2028. The European Central Bank and the Bank of Canada have begun reducing interest rates in spite of concerns about inflation. It is anticipated that the Monetary Policy Committee of the RBI will maintain stable interest rates. With a 2 percent margin on each side, the government has given the RBI the mandate to keep retail inflation at 4 percent. Experts think that the current economic growth momentum may prevent the RBI from reducing rates, even in spite of the high repo rate. SBI recommended that the Central Bank stick to its present course on the withdrawal of accommodation. The RBI has forecast a third-quarter reduction in the repo rate. Forecasts of inflation The SBI report states that CPI-based retail inflation is anticipated to decrease from 5% in May to 3% by July. According to the estimate, inflation would not exceed 5 percent from October 25 through the end of 2024. In April, retail inflation was measured at 4.83 percent. Effects on the Real Estate Market According to real estate specialists, the housing market would be supported and home purchasers will benefit from the repo rate being steady. It is stated that the RBI’s decision will have a significant impact on the real estate market’s demand and overall economic growth.